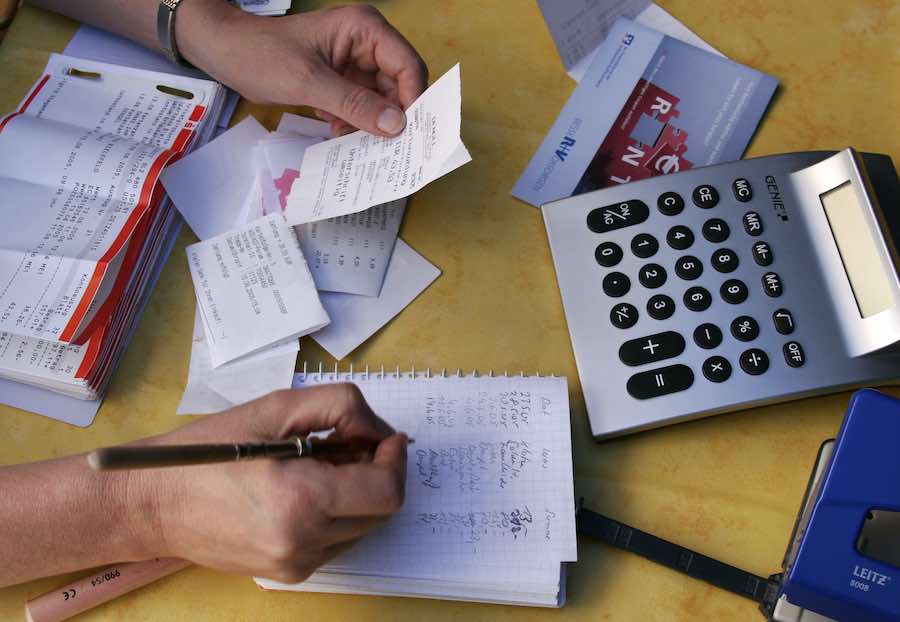

When you’re in the red, you think of creative ways to cut your expenses. Unfortunately, paying your monthly bills is one cost that isn’t easy to cut. Many people fall into debt because they can’t meet their monthly obligations. The pressure of paying bills can be overwhelming, but there are many ways to deal with this situation.

Paying your bills on time every month is crucial and helps reduce stress in the long run. There are several ways to pay your bills such as using a personal budgeting app or setting up automatic payments. In this blog post we explore the best and worst options for paying your bills so that you can choose which one works best for you.

Paying Bills with a Credit Card

You may think that using a credit card to pay your bills would be a good idea since it’s a quick and easy way to pay your bills. However, this is a very unwise decision. When you use a credit card to pay your bills, it causes your credit score to decrease. Your credit score is a three-digit number that lenders use to determine what interest rate you will be charged for loans.

If your credit score is too low, you may not qualify for any loans, including mortgages. Using a credit card to pay your bills will also cause you to fall into debt very quickly. Credit cards have very high interest rates, and it’s extremely difficult to pay off the full balance on a credit card each month. Avoid paying your bills with a credit card at all costs.

Auto Bill Pay

Auto bill pay is a convenient and quick way to pay your monthly bills. You choose a day each month when each bill is automatically paid so that you don’t have to worry about missing a payment. With auto bill pay, you can pay your bills online with a click of a button. However, there are some drawbacks to using this method to pay bills. If one of your bills isn’t paid on time, your credit score will decrease.

Your bills will also be reported as being late, which is not a good thing. If you miss a payment, you will incur a fee, which will cost you even more money. If you have a large amount of bills to pay out at once, you might have to pay additional fees for insufficient funds. It’s important to note that if you pay your bills automatically, you won’t get the interest that you would from a savings account.

Using a Personal Finance App

If you’re looking for a way to efficiently keep track of your bills, a personal finance app is a good option. There are many apps on the market that allow you to track expenses, keep track of bills, and even create budgets. Some of the best personal finance apps include Mint, iExpenses, and Acorns.

Using a personal finance app makes it easy to keep track of your bills because they are all in one place. You can add your bills and set up automatic reminders so that you don’t miss a payment. One drawback of using a personal finance app is that it can be difficult to track your overall progress in paying off your bills. If you want to keep track of your progress, it’s best to use a spreadsheet or notebook as well.

Setting Up Automatic Payments

Many companies offer automatic payment plans. You can set it up so that a certain amount of money is automatically withdrawn from your bank account each month to pay your bills. This ensures that you don’t miss any payments. Automatic payments are convenient because you don’t have to remember to pay each bill every month.

However, it’s important to set up automatic payments for bills that you can afford to pay. You don’t want to pay your bills with money that you don’t have. If you set up automatic payments for bills that you can’t afford, you will fall even further into debt. You can use a personal finance app to track all of your bills, which will make it easier to keep track of your expenses.

Borrowing From Family and Friends

This is a bad idea because you may not be able to pay your relatives back. In many cases, family members and friends are willing to help you out with a small loan, but it’s important to be careful. Don’t borrow money that you can’t pay back. This will only cause more stress and will damage relationships. If you need money to pay your bills, it’s best to use a peer-to-peer lending website.

These websites connect borrowers with people who are willing to lend them money for a certain interest rate. You can look for a lender on one of these websites and set up a monthly payment plan to pay them back. This is a good idea because you will be able to get a small loan from a lender at a lower interest rate than a bank loan.

Take Out a Loan

Borrowing money from a bank to pay your bills is a last resort. Before you decide to take out a loan, you should try to cut your expenses and set up a payment plan for your bills. If you have no other option, though, taking out a loan to pay off your bills is your best bet. You can take out a personal loan or a home equity loan.

With a personal loan, you can pay off your bills and get the money that you need. Your monthly payments will include your loan payment and the money that you owe on your bills. With a home equity loan, you use your home as collateral and your monthly payments go towards paying off the loan. When you take out a loan, it’s important to pay it off as soon as possible.

Final Words

Paying bills can be a real pain, but it’s important to do so. You don’t want to fall behind on payments, which will damage your credit score and cause you more stress. There are many ways to pay your bills, but it’s important to choose a method that works best for your financial situation. If you are having a hard time paying your bills, you can contact a financial advisor to help you come up with a payment plan.